By: Diana Maricruz Perez Santos

When I wrote: “Junk food: the working class hero” I was outraged. The government of my country (Mexico) decided to approve a tax on “junk food” as a solution for the high rates of obesity and diabetes. This imposition did not take into account the current situation of poverty in the country. Now, a year later I will analyze the changes that have occurred due to this tax.

Forever capitalist

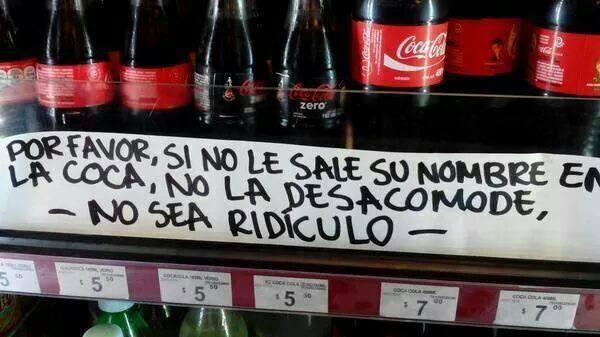

The ambiguous way the tax was established was the biggest mistake made by the Mexican government. Companies did not understand the aim of this tax; they increased food prices equally even if the products were not taxed. This means that consumers now pay the same for a high-calorie product (with tax) or a product with a lower calorific value (without tax)1. Marketing strategies were also immediate. Halfway through last year, all Mexicans went crazy trying to find a can of soda with their names on it. So, the increase in price was overlooked. Hats off to who invented this idea because this helped avoid the millions of losses predicted for this company as effect of this tax.

“Please, if you did not find your name on the soda, don’t disturb it –Don’t be ridiculous” source: www.fusionmediamag.com

Tip of the iceberg

A tax on junk food was justified with the promise to use the money on programs to prevent obesity and install water fountains at schools2, however up to date these have not come to fruition. 2014 was a politically intense year for Mexico, some isolated manifestations for this tax were carried out3, but other issues won the indignation of the public, making people almost forget the tax (maybe you heard news about the 43 students that went missing in the country).

source: www.litinn.com

The Results

This intention of this post is to show the changes one year after implementation of this tax and let the reader evaluate. It is still too early to have statistically reliable information. The news speak of4 a 2% reduction in the rate of diabetes-related deaths and a 10% less in soft drinks sales, but I would be lying if I presented this as a result of the tax.

My constructive / destructive criticism

The original concept for the implementation of this tax is good if you do not consider that this is a place where 45.4% of the population are poor (defining poor as a person with an income below that required for the minimum wellbeing line5) and alternatives to have a balanced diet are beyond the purchasing power of the population. It is urgent to solve the problem of diabetes and obesity in Mexico, but I do not need to be a politician to know that the implementation of a tax must bring benefits at short, medium and long term for the population. There are several points where this initiative came up short because it still has not supported the installation of water fountains at schools, the promotion of healthy food choices and/or the support for acquisition of these, and it does not regulate companies on prices for consumers. All this without mention that it obviously ignored all the research done in this country related to the reduction of diabetes and the development of foods that allow the population have a balanced diet at a good cost 6.

source: www.informador.com.mx

Not all is lost

After “Junk food: the working class hero” I was grateful that a person with a law degree tried to meet with me to ask my opinion about sugary cereals (SMF is more popular than you might imagine). Some of her questions may be obvious for those who study food science, but they showed me that others are interested in learning about this subject. The lesson learned at the end showed that there is still much to do inside and outside the classroom to generate real changes to the problems related to food. Our panorama must be wide, probably most of us won’t be involved on a food law redaction, but we can support with real information what happened in our area so it is not overlooked.

References

1Price of 600ml & 2l PET bottle sizes of regular soda vs diet soda at 02/04/2015 on 4 supermarket’s: Comercial Mexicana, Soriana, Walmart and Superama

2Full political initiative available at: http://www.senado.gob.mx/?ver=sp&mn=2&sm=2&id=38519http://www.senado.gob.mx/?ver=sp&mn=2&sm=2&id=38519

3Some videos about people trying to avoid junk food tax in different parts of Mexico: http://www.youtube.com/playlist?list=PL-NtDcE435JFqQ747iHfYwiMyxYiEtrbe

4 http://www.jornada.unam.mx/ultimas/2014/10/31/bajan-2-muertes-por-diabetes-en-un-ano-destaca-secretaria-de-salud-1116.html , http://www.milenio.com/negocios/Consumo_refresco-impuesto_a_bebidas_azucaradas-encuesta_nacional_de_obesidad_0_389961184.html

5 The National Council for the Evaluation of Social Development Policy web site(CONEVAL, Consejo Nacional de Evaluación de la Política de Desarrollo Social) http://www.coneval.gob.mx/Medicion/Paginas/Lineas-de-bienestar-y-canasta-basica-en.aspx

6 CIMMYT (The International Maize and Wheat Improvement Center): http://www.cimmyt.org/en/ , CEPROBI (Development Center Of Biotic Products): http://www.ceprobi.ipn.mx/investigacion/Paginas/Departamento-de-Nutrici%C3%B3n-Alimentos-Funcionales%20.aspx, BioRed (Biotechnology for Food and Agriculture network)del CONACYT (National Council for Science and Technology): http://biored-conacyt.mx/, Cinvestav (Center for Research and Advanced Studies of IPN) tortilla related projects: http://www.maiztortilla.com/es/proyectos/intro.htm

Cover image source: www.laprimeraplana.com.mx

You may be interested in reading this…

http://alianzasalud.org.mx/2014/10/senadora-marcela-torres-pide-asignar-recursos-del-impuesto-a-refrescos-para-bebederos-en-escuelas/

Thanks, I read it when I was writing the post. I don’t have any comment on it. Politicians must protect people interests and that is the reason why we choose them as representatives. I don´t want to be mean but it is not a miracle for a politician that was involved on the tax implementation to ask for results. It is only her job. Anyways, I hope to get some good news soon about the benefits of this tax.

MUY BUEN TRABAJO E INTERESANTE MARICRUZ, FELICITACIONES

Dilemmas we find ourselves in… Do we force people to go hungry so that they are protected from chronic diseases, or we let the eat whatever they want but deal with the health complication later??????

Hi Joakin, That is a question that I am looking answer of the public. Junk food as the most accessible food in Mexico was not a problem until the economical value for attended chronic diseases be increased. Now, the tax may help to solve this new problem unless it used properly, otherwise we will return at the original problem: How to feed everybody?….Because, We can to fit to live in all kind of conditions except without food.

Hola, hay algun email donde se pueda contactar a Diana, gracias

Hola Estefania mi email diana.maricruz.dmps@gmail.com Saludos

All you need to do to turn a problem into a full-blown disaster, is get the government involved.

If you really want to alter consumption behaviors, add real education – not propaganda – and allow people to make informed choices.

If, however, you want abuses of power, unintended consequences, reduced employment, increased living costs and money disappearing down the great rabbit hole of bureaucratic government, just impose another tax.

Hi Diana,

This article was an interesting read and I found that this issue is highly applicable across the world as I am currently a student studying Food Management in South Africa.

Agreeing with your position on this issue, the government should note the fact that fast food meals may be the only and most affordable meal poverty stricken individuals have access to. Fast food outlets also offer a cheap means of achieving somewhat of a balanced meal, which these individuals would otherwise not be able to afford. For example, in the case of a McDonald’s burger, the individual gets all five of the main food groups by paying a single, low price, while if they were to make this themselves in a healthier manner, the consumer would have to buy each ingredient separately at a higher cost.

Therefore, would you agree that a more efficient and effective solution to the issue of obesity and Diabetes Mellitus in a global scope could be to introduce legislation that regulates health qualities and ingredients of food produced by Fast food outlets rather than impose high taxes on these products?